Real estate investment is vast, offering numerous pathways for growth, wealth accumulation, and strategic diversification of investment portfolios. Among the avenues available to investors seeking to maximize their real estate investments while minimizing tax liabilities, the 1031 exchange stands out as a potent tool. But how does this process apply to buying land? Can investors really buy land with a 1031 exchange? Let’s dive into the specifics to clarify this intriguing aspect of real estate investment strategy.

The Basics of 1031 Exchange for Land

At its core, a 1031 exchange involves two key transactions: the sale of one property and the subsequent acquisition of another, both of which must be of “like-kind.” This term is broader than it appears; for landowners, it means that land can typically be exchanged for nearly any type of real investment property—from agricultural plots to office buildings. The primary lure of a 1031 exchange is its benefit of deferring capital gains tax, potentially saving landowners substantial sums of money and allowing those funds to be reinvested immediately.

The Possibility of Acquiring Land With a 1031 Exchange

Yes, you CAN buy land with a 1031 exchange. This is pivotal information for investors looking to diversify or shift their investment strategies. The key criterion for such an exchange is that the land must be held for investment or business purposes; personal use does not qualify. Whether you’re selling a commercial building, an apartment complex, or even another piece of land, you can use those proceeds to purchase a new piece of investment land under the umbrella of a 1031 exchange.

Why Land?

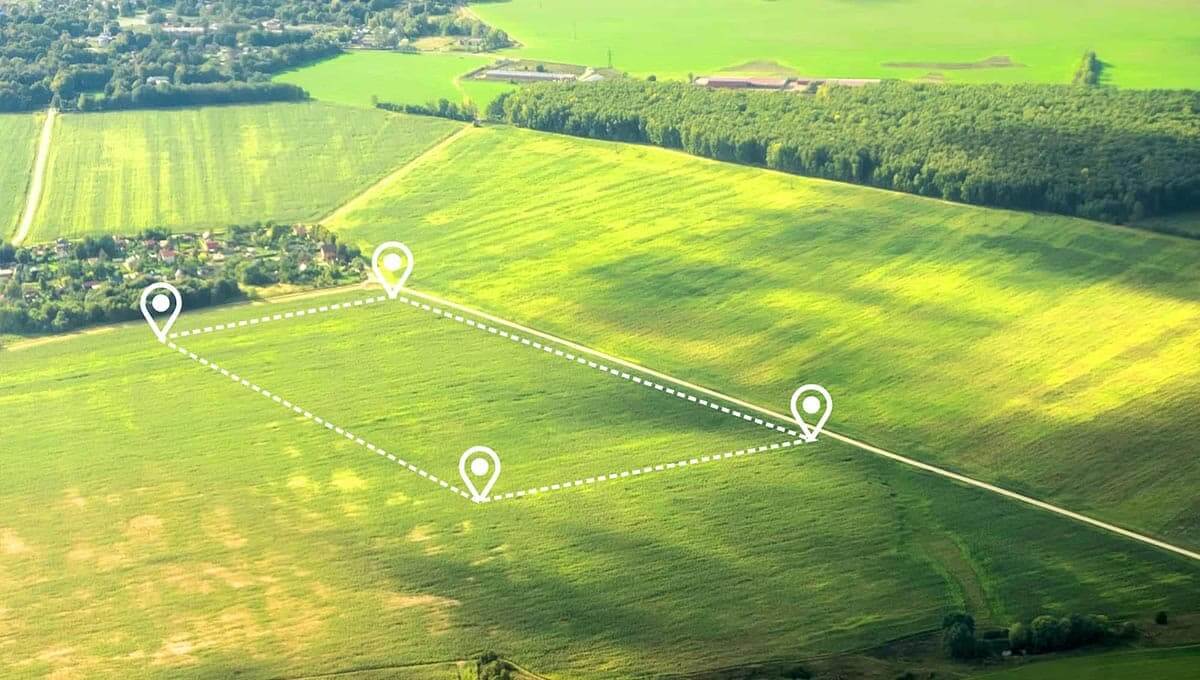

Land is a uniquely appealing asset for several reasons. It’s a finite resource, which can contribute to its appreciation over time. Investment land offers versatility—it can be developed (subject to zoning regulations) or potentially used for agricultural, commercial, or recreational purposes, depending on the investor’s goals and the land’s location and attributes.

Deferring Capital Gains Taxes

The deferral of capital gains taxes is undoubtedly the most compelling advantage of a 1031 exchange. When land is sold, the owner is liable to pay taxes on the gain. Depending on the duration of ownership and the nature of the gain, these taxes can be steep. In contrast, by utilizing a 1031 exchange, these taxes are not immediately due. Instead, the tax obligation is deferred until the new property is sold—potentially indefinitely if the new property is, in turn, swapped in another 1031 exchange. This deferral can provide a significant cash-flow advantage, offering landowners more capital to invest immediately.

Portfolio Diversification

Diversification is a cornerstone principle in investment, serving to mitigate risk and potentially enhance returns. Landowners can use 1031 exchanges to transform a single-property investment into multiple assets spread across different geographical locations and property types. For instance, agricultural land could be exchanged for a share in a commercial rental property, spreading and potentially reducing the investment’s risk profile. Diversification makes financial sense and allows landowners to explore new markets and sectors.

Access to Higher Value and Better Performing Assets

A strategic 1031 exchange can significantly bolster a landowner’s portfolio by facilitating the acquisition of higher value or better-performing assets than might be possible through a direct sale and repurchase strategy. By deferring tax liabilities, more capital is at the landowner’s disposal in the short term, enabling purchasing more lucrative properties. Identifying such properties requires diligent market research and possibly leveraging professional networks to uncover the best opportunities.

Estate Planning Advantages

From an estate planning perspective, 1031 exchanges offer an enticing prospect for landowners looking to pass on assets to their heirs. Not only can these exchanges streamline the process of consolidating or restructuring property holdings for future generations, but the deferred tax liability also means that heirs may receive a more valuable portfolio. Additionally, under current laws, the property passed on due to the owner’s death steps up in basis to the market value at the time of death, potentially erasing the deferred tax liability entirely.

Leveraging Opportunities

The financial leverage available through a 1031 exchange can’t be understated. By deferring tax payments, landowners can potentially leverage their new property purchases far more effectively than in a traditional buying scenario. This can include using the additional capital for down payments on multiple properties or improving existing assets to boost their value. Careful management of leverage is essential, as increased debt levels can also increase risk. Nonetheless, executed wisely, leveraging via a 1031 exchange can amplify returns significantly.

The 1031 Exchange Intermediaries team offers multiple strategies designed to streamline your transaction. Explore our solutions today.

Navigating the Tight Timelines

First and foremost, the IRS-imposed timelines—the 45-day identification window and the 180-day purchase completion period—create a race against time that requires meticulous planning and swift action. The 45-day window starts from the day of selling the relinquished property, within which an investor must identify potential replacement properties. Following this, the next phase is a 180-day period to finalize the purchase. This rigid timeframe necessitates a proactive approach, where potential properties should ideally be scouted even before the relinquished asset is sold. Failing to meet these deadlines nullifies the tax-deferral benefits, making adherence a top priority for investors.

Locating Like-Kind Properties

Finding a suitable replacement property poses another significant hurdle. “Like-kind” in the context of a 1031 exchange is broad, encompassing nearly all types of real estate held for business or investment purposes. However, matching or exceeding the value of the relinquished property to fully defer capital gains taxes, requires strategic insight. Market dynamics further complicate this search, with variables such as property availability, competing investors, and regional real estate trends influencing the feasibility of securing an ideal replacement.

Buy Land With a 1031 Exchange With Our Team

Utilizing a 1031 exchange for rental property for land or other purposes requires expert knowledge of the process.

The 1031 Exchange Intermediaries team has over two decades of experience and leverages our knowledge to streamline transactions and prevent delays and mistakes. We have experience with multiple strategies, including:

Contact us today to learn more.