For many, the allure of a vacation property nestled in the mountains, by the sea, or amidst serene countryside is…

Category: 1031 Exchanges

Real estate investment is vast, offering numerous pathways for growth, wealth accumulation, and strategic diversification of investment portfolios. Among the…

When most people think of 1031 exchanges, they conjure images of residential properties swapping hands in a tax-deferred sanctuary. However,…

The world of real estate can seem complex and daunting. One of the key areas of confusion often revolves around…

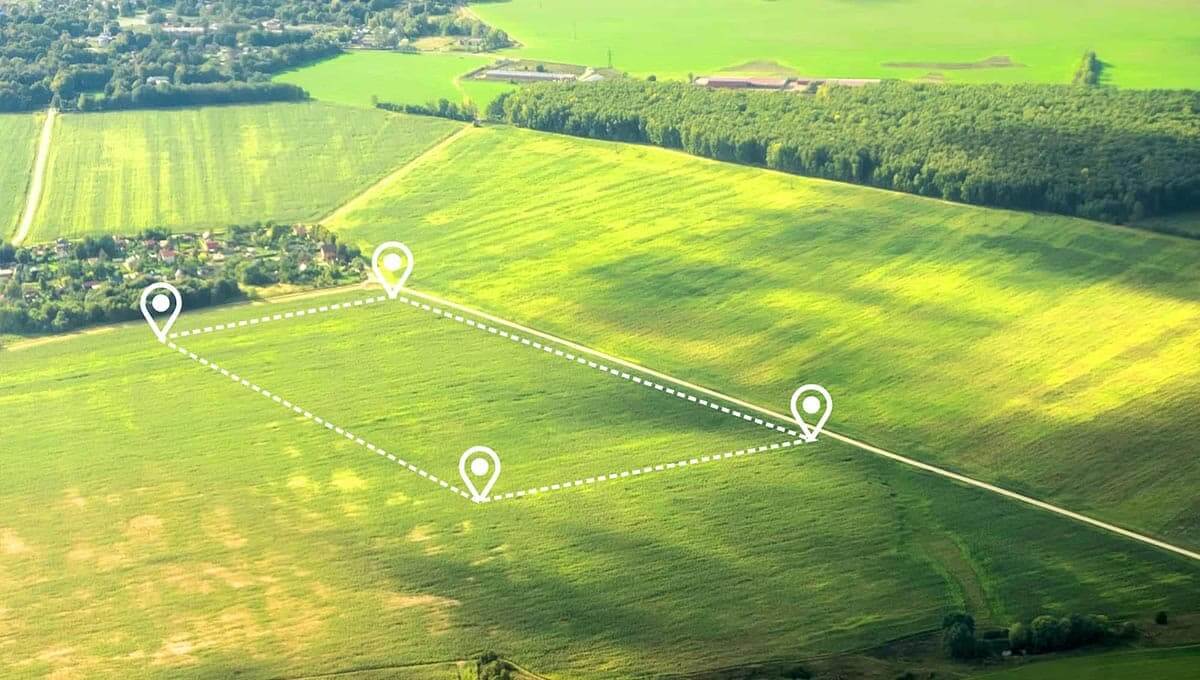

In real estate, a 1031 exchange refers to swapping one investment property for another. The transactions allow investors to defer…

The 1031 exchange, often referred to as a like-kind exchange, is a powerful tax strategy that allows real estate investors…

Real estate has long been a popular investment avenue for individuals and businesses. However, the tax implications of buying and…

Investing in real estate can be a lucrative venture, but it also involves making strategic decisions about how to manage…

Real estate investment can be a lucrative endeavor, but it’s essential to understand the various tax implications and strategies associated…